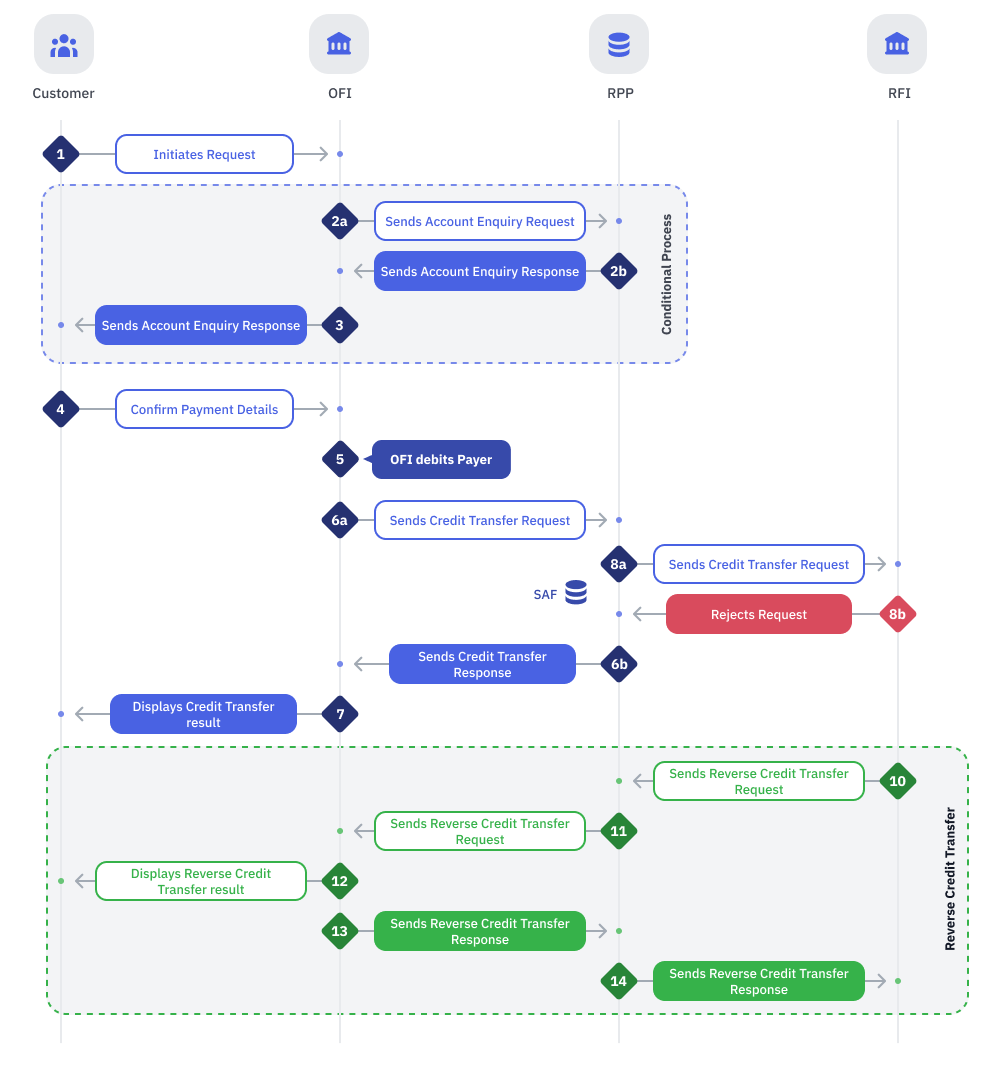

Credit Transfer Reversal

When there's a timeout at RPP (which can occur if the request wasn't sent to the RFI or if RPP didn't receive a response from the RFI), the status of the transaction becomes unknown. To handle this, the transaction is saved in the Store and Forward (SAF) queue so that it can be sent to the RFI again. After resending, some transactions may succeed, while others may be rejected or still remain unknown if the timeouts keep happening and the maximum retry attempts have been reached. Reversal transactions with the status ACSP and ACTC can be updated immediately.

When transactions encounter timeout issues at the RFI and remain unknown even after reaching the maximum number of retries, the OFI and RFI will need to address them separately from RPP. On the other hand, for successful transactions, the payment amount will be reversed accurately.

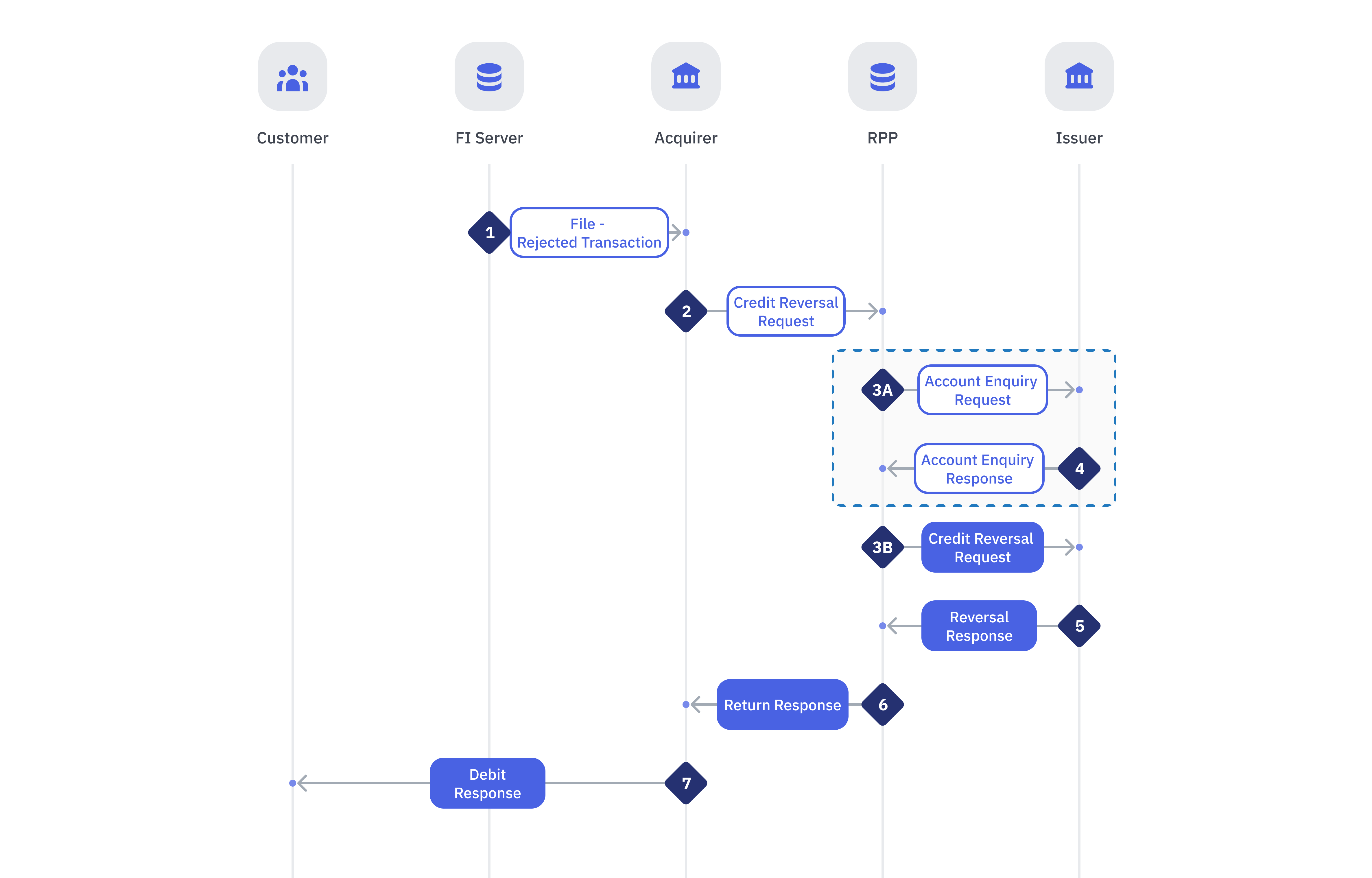

Credit Transfer Reversal for SAF Rejected Transactions

For this process, only the transactions that have been processed by SAF but then ended with a rejection status will be included into a data file for banks to download from the staging server. When the RFI receives this file, an automated process in the RFI will be triggered to initiate a reverse Credit Transfer back to the Originating FI one by one

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | PayNet | Acquirer (RFI) | PayNet will provide a Back Office portal where RFI can view the transactions that were rejected by them Transactions that are in rejected status can either be due to timeout, maximum retries has been exceeded or an outright rejection by the RFI |

| 2 | Acquirer(RFI) | RPP | OFI performs the following:

|

| 3A,3B | RPP | Issuer(OFI) | RPP performs the following:If any of the Message Validations fails:

|

| 4 | Issuer (OFI) | RPP | OFI performs the following:If any of the Message Validations fails:

|

| 5 | Issuer (OFI) | RPP | OFI performs the following:If any of the Message Validations fails:

|

| 6 | RPP | Acquirer (RFI) | RPP Return Response to RFI RPP performs the following: If any of the Message Validations fails:

If the signature received from OFI could not be verified:

|

| 7 | Acquirer (RFI) | Customer | RFI performs the following:If all validations are successful:

|

- The exception scenarios will be handled similarly toCredit Transfer flows

- While performing credit transfer reversals, it is important to keep in mind the maximum time or date allowed for the reversal. It is advisable not to execute reversals too frequently without considering this limitation, as there won't be any checks in place to prevent it.

Credit Transfer Reversal for Immediate Reversal

For this process, transactions that have been processed by SAF but then ended with a rejection status will be reversed by RFI/Acquirer immediately. This is to support certain payment flows that requires the credit to be reversed immediately to reduce unnecessary manual reconciliation especially to the OFI/Issuer.

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 8b | PayNet | RPP | RFI performs the following:

|

Reversal

- The exception scenarios will be handled similarly toCredit Transfer flows

- While performing credit transfer reversals, it is important to keep in mind the maximum time or date allowed for the reversal. It is advisable not to execute reversals too frequently without considering this limitation, as there won't be any checks in place to prevent it.