Biller Validation Module (BVM)

API reference

Introduction

PayNet is facilitating an industry wide initiative to implement ubiquitous online bill payments for Malaysia, called the National Bill Payment Scheme (NBPS). Its fundamental purpose is to facilitate Customers to make online payment of ANY Bill at ANY IBG Bank in Malaysia.

This document provides the technical specifications for how Payer Banks interface with the Biller Validation Module of NBPS to perform online Validation of bill payments and to provide successful bill payment Notifications to Billers.

Biller Validation Module (BVM)

The Biller Validation Module (BVM), which is a part of the NBPS system, is an online service provided by and hosted at PayNet. The Payer Bank makes online web-service calls to the BVM when validating and notifying successful NBPS bill payment transactions. The BVM service is available to the Payer Bank 24 hours daily to facilitate the NBPS bill payment capability.

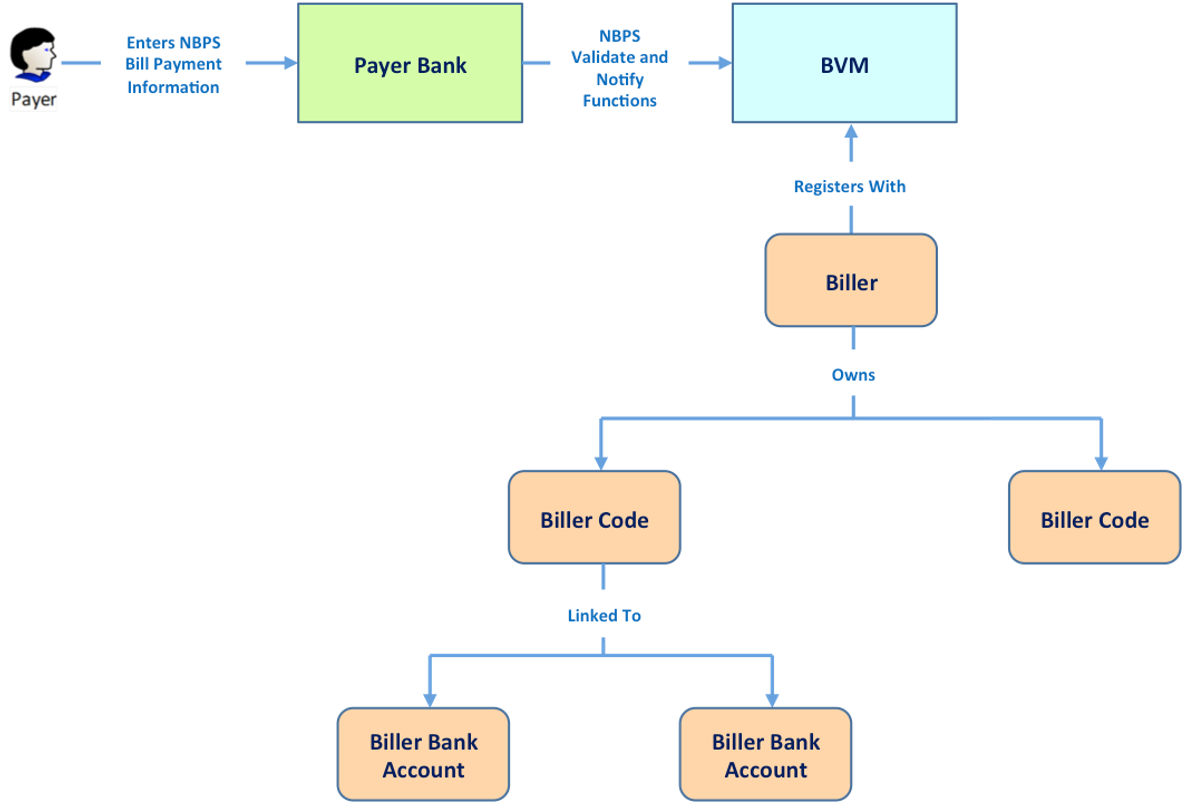

The following is a summary of the key components involved in the usage scenario for the BVM.

| Role | Description |

|---|---|

| BVM | Biller Validation Module, which provides online NBPS bill payment Validation and Notification functions; and is provided and hosted at PayNet on a 24 hours daily basis |

| Payer | The Customer who is performing the bill payment transaction |

| Payer Bank | The Bank of the Payer where he/she has an account and is where he/she is conducting the NBPS bill payment transaction from |

| Biller | An Entity that provides goods and/or services for which the Payer requires to make a bill payment to |

| Biller Code | Code used to identify which Biller service a bill payment is for. A Biller will usually have one, but may have multiple Biller Codes |

| Biller Bank Account | Bank and Account of the Biller where the bill payment funds will be credited. A Biller Code may have multiple Biller Bank Accounts attached to it and the appropriate one will be advised by the BVM according the Biller’s requirement |

BVM Interaction Flow

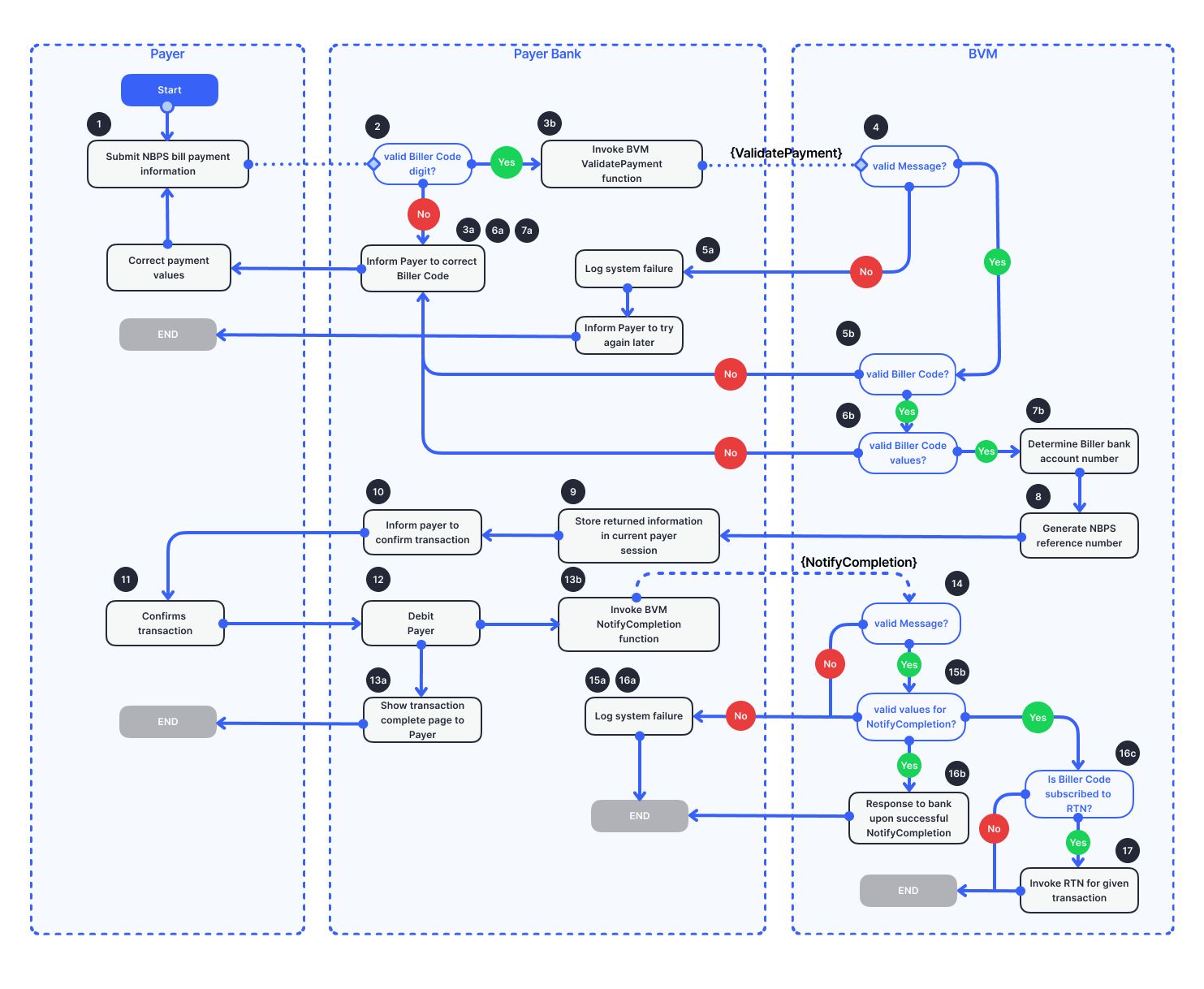

The flow of interactions between the Payer, Payer Bank and BVM is depicted and described below.

The following provides a high level description of the flow of interactions between the Payer, Payer Bank and BVM – a more detailed description is provided in the following sections:

- The Payer selects the account to debit and enters the Biller Code, primary Reference Number (RRN), secondary Reference Number (RRN2 if indicated on their Bill) and Amount (from their Bill) at the Payer Bank’s payment channel to initiate the NBPS bill payment transaction.

- Payer Bank sends a validation request to BVM, which includes the above information, and BVM performs various validations according to the Biller’s requirements. The Payer Bank must validate via BVM all NBPS bill payments.

- If the provided information is invalid or insufficient, BVM will return the error reason and the Payer Bank will inform the Payer to correct any errors.

- If the provided information is sufficient and valid, BVM will check if the Payer Bank owns any of the Biller Bank Accounts attached to the Biller Code. If there is a matching Biller Bank Account then that account will be chosen. Otherwise, the designated Master Bank Account for the Biller Code will be used.

- BVM returns the Biller Bank Account information along with the Biller & Biller Code name, a NBPS Reference No. for the transaction, and other information. The returned information also indicates whether the Biller has requested a Real Time Notification (RTN) of successful payment.

- The Payer is then prompted by the Payer Bank to confirm the entered bill payment information (which includes the returned Biller Code name and information related to the primary Reference Number) and the Payer Bank proceeds to debit the Payer’s account. If the debit was successful, the Payer Bank will then credits the Biller Bank Account (via IBG for Inter-bank transaction or via the Payer Bank’s internal system for Intra-bank transaction – refer to Notes 1 and 2).

- Regardless if RTN was requested by Biller or not, the Payer Bank will invoke the online notification (NotifyCompletion) function via BVM. When BVM receives the online notification from the Payer Bank, if an RTN was requested by the Biller (indicated in the validation response message), then only BVM will deliver the notification to the Biller.

- The Payer Bank will then display the transaction completion page to the Payer, which will include the NBPS Reference Number.