Integration

The DuitNow Online Banking/Wallets API enables seamless integration, allowing merchants to accept payments from customers using their preferred bank or wallet through DuitNow Pay. This API is essential for Issuers and Acquirers, ensuring smooth payment processing and linking merchants with a wide range of financial institutions and digital wallets.

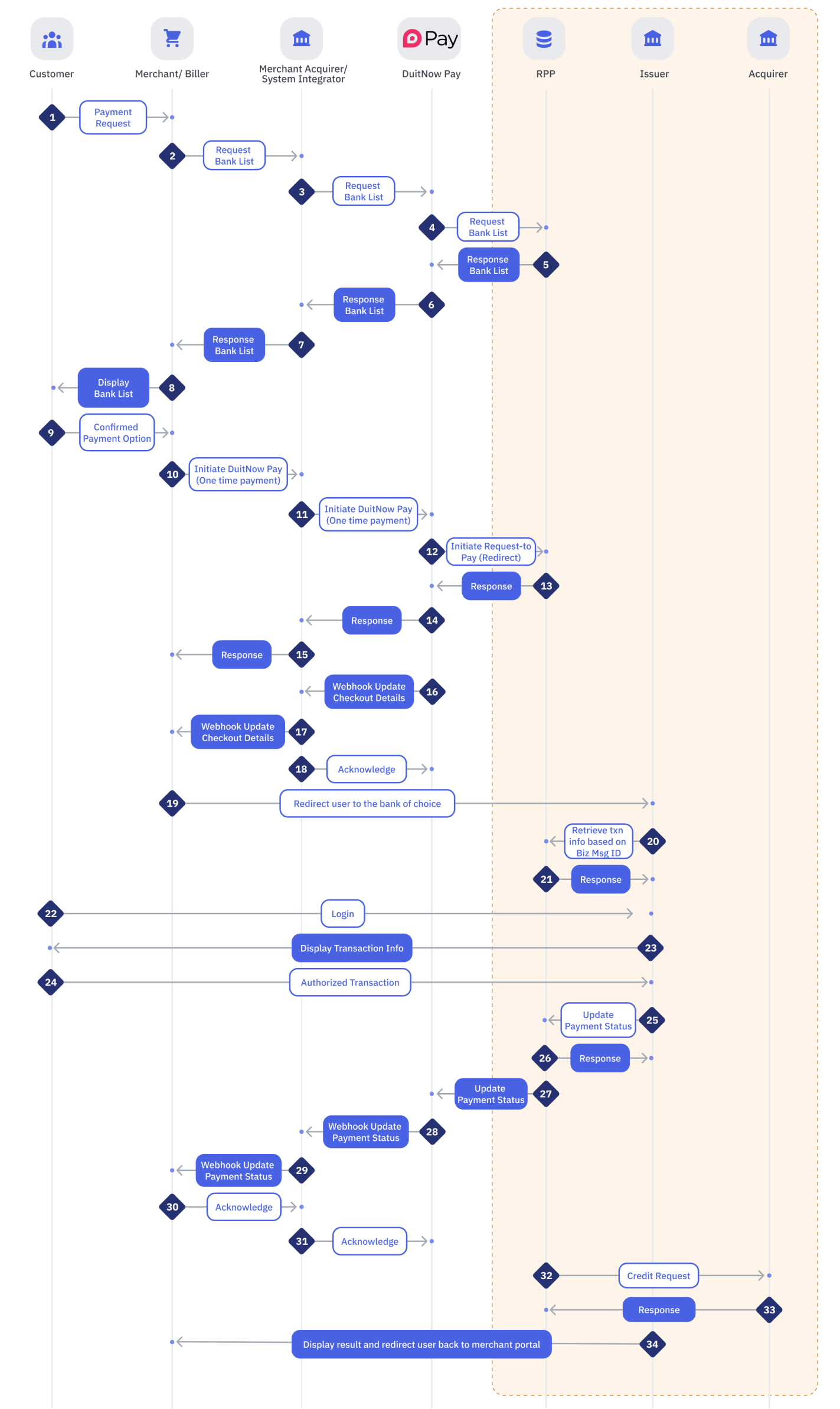

The diagram below provides a detailed overview of the DuitNow Online Banking/Wallets process.

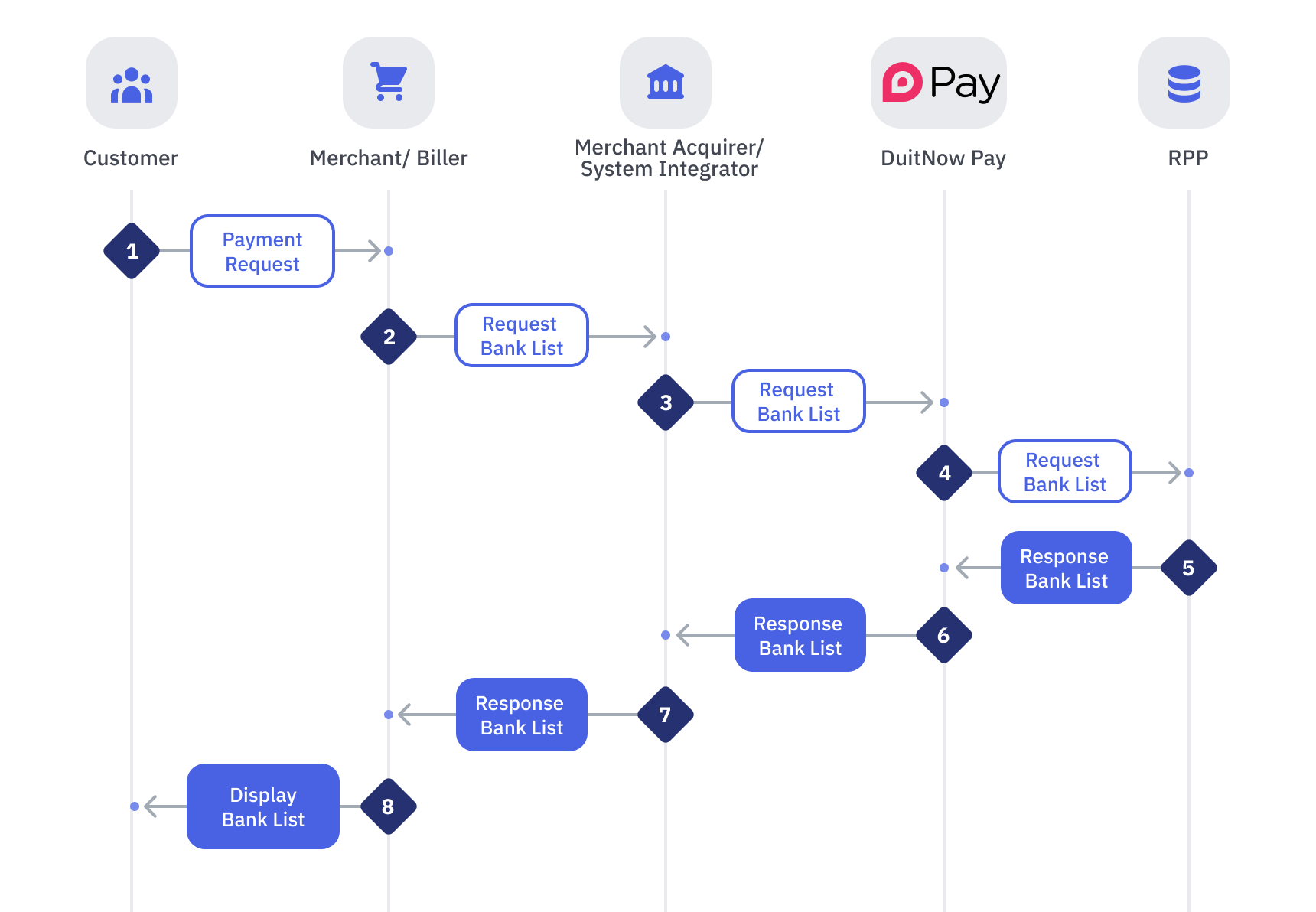

Successful Redirect - Request List of Banks Flow (Steps 1-8)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Customer | Merchant/Biller | Customer initiates payment via Merchant/Biller Portal. |

| 2 | Merchant/Biller | Merchant Acquirer/System Integrator | Merchant/Biller performs the following:

|

| 3 | Merchant Acquirer/System Integrator | DuitNow Pay | Merchant Acquirer/System Integrator performs the following:

|

| 4 | DuitNow Pay | RPP | DuitNow Pay performs the following:

Note:

|

| 5 | RPP | DuitNow Pay | RPP performs the following:

If any Message Validation fails, RPP will:

If all validations are successful, RPP Back Office will:

Note:

|

| 6 | DuitNow Pay | Merchant Acquirer/System Integrator | If any Message Validation fails, DuitNow Pay will:

If all validations are successful, DuitNow Pay will:

|

| 7 | Merchant Acquirer/System Integrator | Merchant/Biller | Merchant Acquirer/System Integrator will:

|

| 8 | Merchant/Biller | Customer | Merchant/Biller performs the following:

|

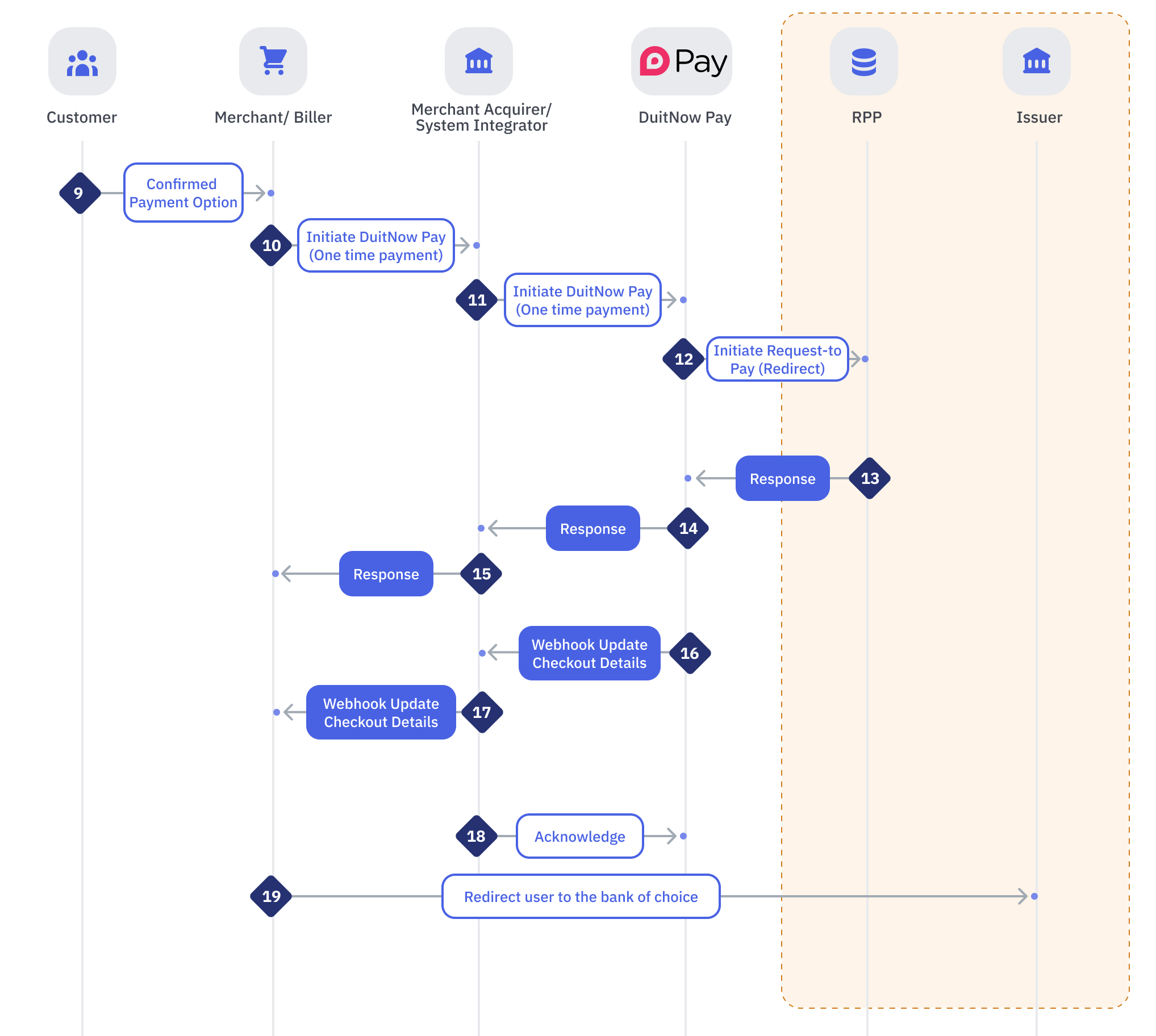

Successful Redirect – Request-to-Pay Flow (Steps 9-19)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 9 | Customer | Merchant/Biller | Customer confirms payment option and initiates One Time Payment via DuitNow Pay. |

| 10 | Merchant/Biller | Merchant Acquirer/System Integrator | Merchant/Biller will perform the following:

|

| 11 | Merchant Acquirer/System Integrator | DuitNow Pay | Merchant Acquirer/System Integrator performs the following:

|

| 12 | DuitNow Pay | RPP | DuitNow Pay will perform the following:

Note:

|

| 13 | RPP | DuitNow Pay | RPP performs the following:

If any Message Validation fails, RPP will:

If any Business Validation fails, RPP will:

If all validations are successful, RPP will:

Note:

|

| 14 | DuitNow Pay | Merchant Acquirer/System Integrator | If any validation fails, DuitNow Pay will:

If all validations are successful, DuitNow Pay will:

|

| 15 | Merchant Acquirer/System Integrator | Merchant/Biller | If any validation fails, Merchant Acquirer/System Integrator will:

If all validations are successful, Merchant Acquirer/System Integrator will:

|

| 16 | DuitNow Pay | Merchant Acquirer/System Integrator | DuitNow Pay will be sending the checkout details back to Merchant Acquirer/System Integrator via webhook. |

| 17 | Merchant Acquirer/System Integrator | Merchant/Biller | Merchant Acquirer/System Integrator will be sending the checkout details back to Merchant/Biller. |

| 18 | Merchant Acquirer/System Integrator | DuitNow Pay | Acquirer shall provide an acknowledgment back to DuitNow Pay. |

| 19 | Merchant/Biller | Issuer | Merchant/Biller will redirect Customer to selected bank along with Signature and End-to-End ID to Issuer. |

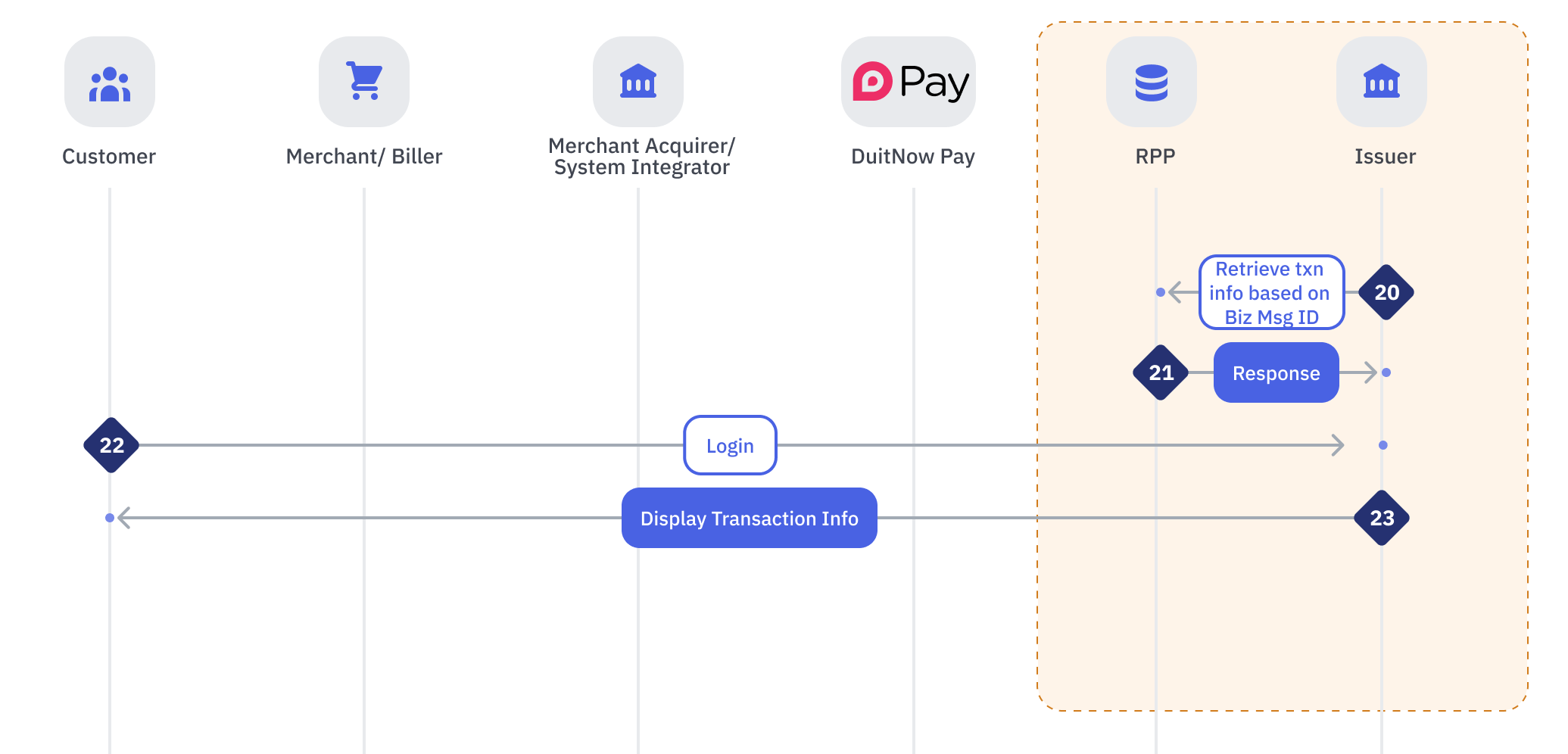

Successful Redirect – Retrieve Transaction Info Flow (Steps 20-23)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 20 | Issuer | RPP | Issuer performs the following:

Note:

|

| 21 | RPP | Issuer | RPP performs the following:

If any Message Validation fails, RPP will:

If any Business Validation fails, RPP will:

If all validations are successful, RPP will:

Note:

|

| 22 | Customer | Issuer | Customer logs into Mobile/Internet Banking portal of Issuer |

| 23 | Issuer | Customer | Issuer performs the following:

If validation fails, Issuer will:

If validation is successful, Issuer will:

|

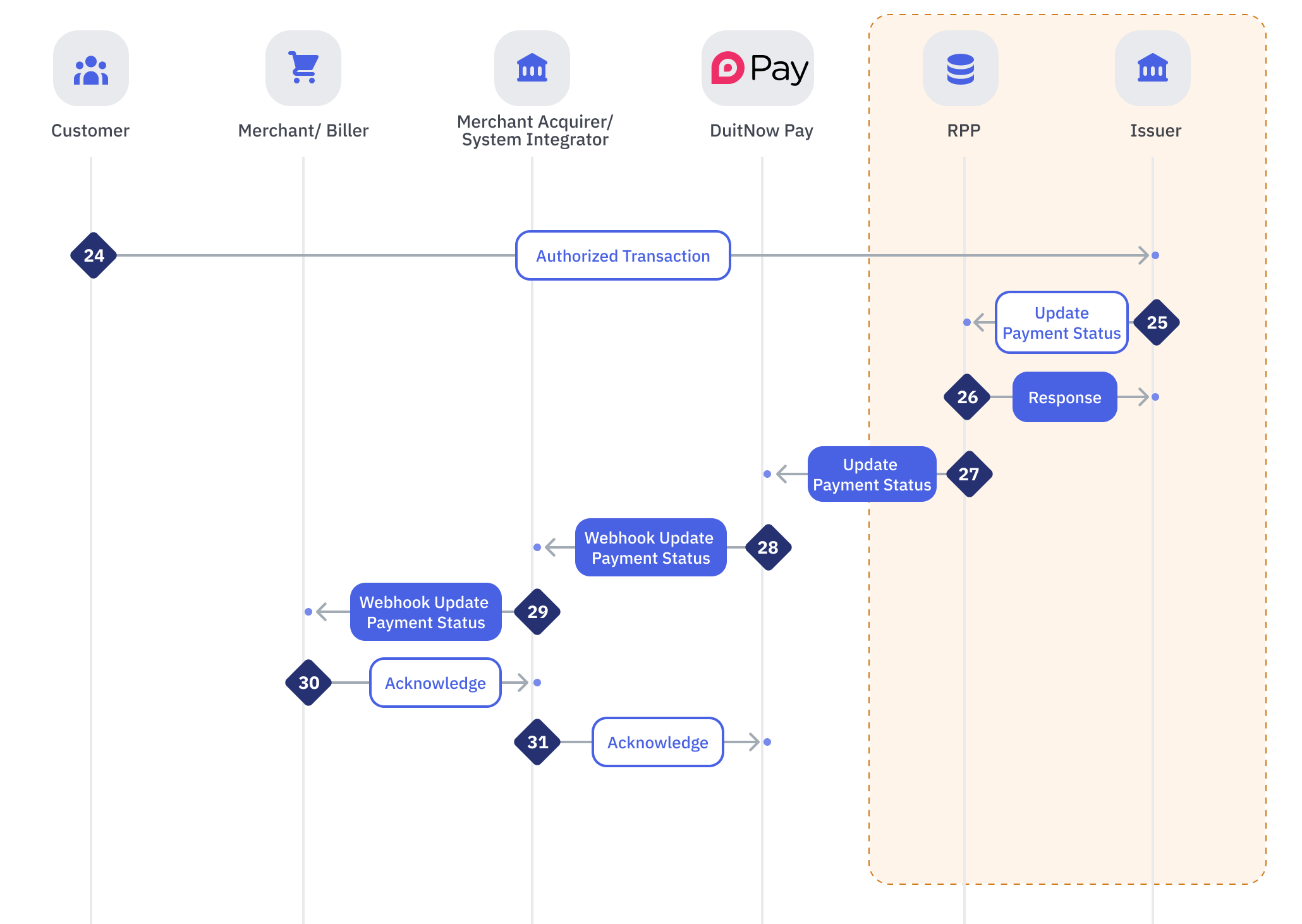

Successful Redirect – Update Payment Status Flow (Steps 24-31)

This is an optional step for scenarios where the Request-to-Pay status needs to be updated either to (a) Rejected, where Issuer has to reject the redirect due to failed login or cancelled payments, or to (b) Pending Authorisation for two-level Authentication.

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 24 | Customer | Issuer | Customer performs the following:

|

| 25 | Issuer | RPP | Issuer performs the following:

Note:

|

| 26 | RPP | Issuer | RPP performs the following:

If any Message Validation fails, RPP will:

If any Business Validation fails, RPP will:

If all validations are successful, RPP will:

Note:

|

| 27 | RPP | DuitNow Pay | RPP performs the following: Notify Merchant of Update Payment Status via DuitNow Pay |

| 28 | DuitNow Pay | Merchant Acquirer/System Integrator | Payment status will be parsed to Merchant Acquirer/System Integrator as part of the webhook. |

| 29 | Merchant Acquirer/System Integrator | Merchant/Biller | Payment status will be parsed to Merchant/Biller as part of the webhook. |

| 30 | Merchant/Biller | Merchant Acquirer/System Integrator | Merchant/Biller shall provide an acknowledgment back to Merchant Acquirer/System Integrator. |

| 31 | Merchant Acquirer/System Integrator | DuitNow Pay | Merchant Acquirer/System Integrator shall provide an acknowledgment back to DuitNow Pay. |

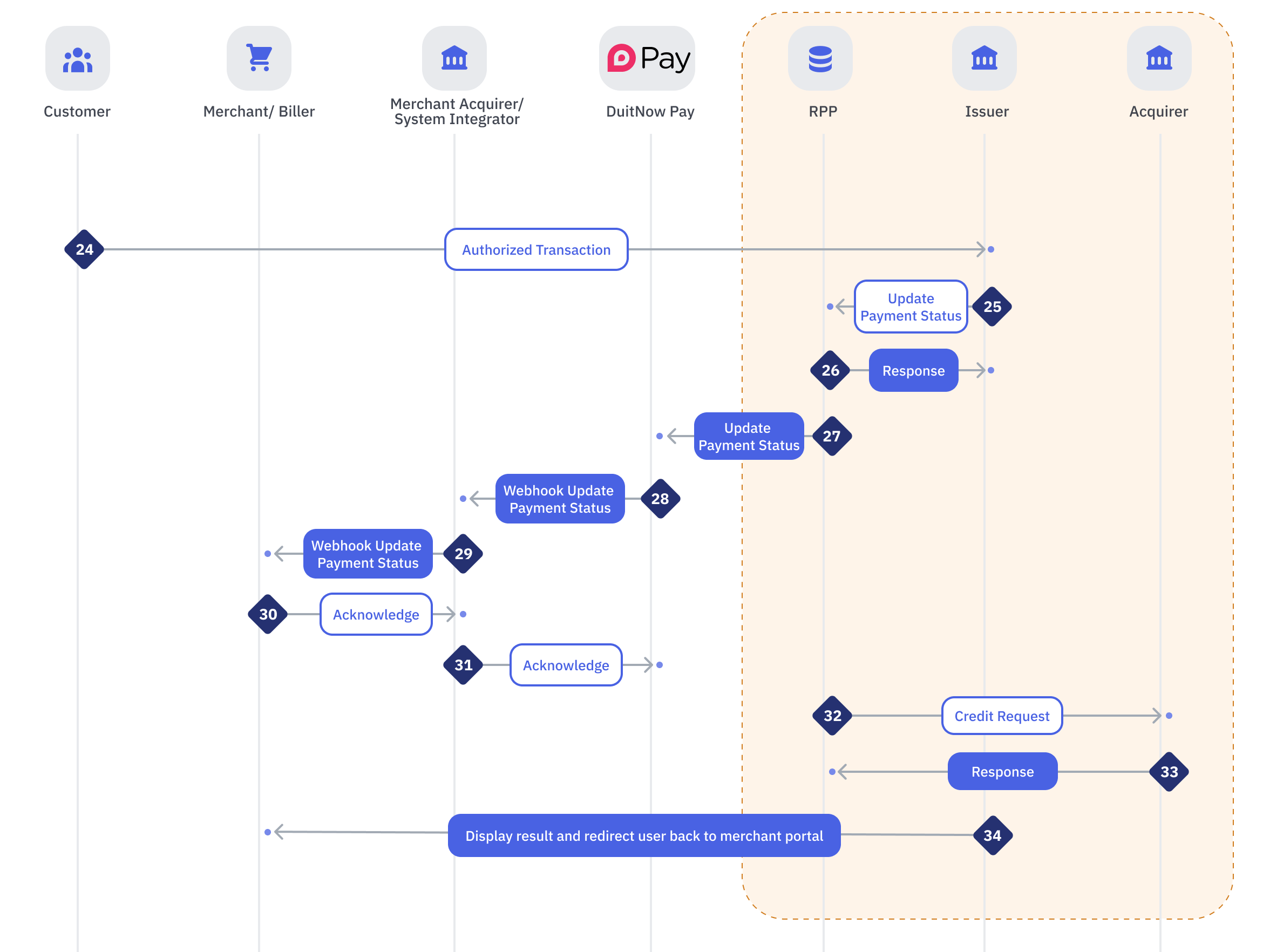

Successful Redirect – Credit Transfer Flow (Steps 24-34)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 24 | Customer | Issuer | Customer performs the following:

|

| 25 | Issuer | RPP | Debiting Agent performs the following :

Note:

|

| 26 | RPP | Issuer | RPP performs the following:

If any Message Validation fails, RPP will:

If any Business Validation fails, RPP will:

If all validations are successful, RPP will:

Note:

|

| 27 | RPP | DuitNow Pay | RPP performs the following: Notify Merchant of Update Payment Status via DuitNow Pay |

| 28 | DuitNow Pay | Merchant Acquirer/System Integrator | Payment status will be parsed to Merchant Acquirer/System Integrator as part of the webhook. |

| 29 | Merchant Acquirer/System Integrator | Merchant/Biller | Payment status will be parsed to Merchant/Biller as part of the webhook. |

| 30 | Merchant/Biller | Merchant Acquirer/System Integrator | Merchant/Biller shall provide an acknowledgment back to Merchant Acquirer/System Integrator. |

| 31 | Merchant Acquirer/System Integrator | DuitNow Pay | Merchant Acquirer/System Integrator shall provide an acknowledgment back to DuitNow Pay. |

| 32 | RPP | Acquirer | RPP performs the following:

Note:

Note:

|

| 33 | Acquirer | RPP | Acquirer performs the following:

If any Message Validation fails, Acquirer will:

If all validations are successful, Acquirer will:

Note:

|

| 34 | Issuer | Merchant | Issuer to display the result to customer and redirect customer back to merchant portal. |