Consumer Presented Mode: Domestic QR

End-to-End Flow

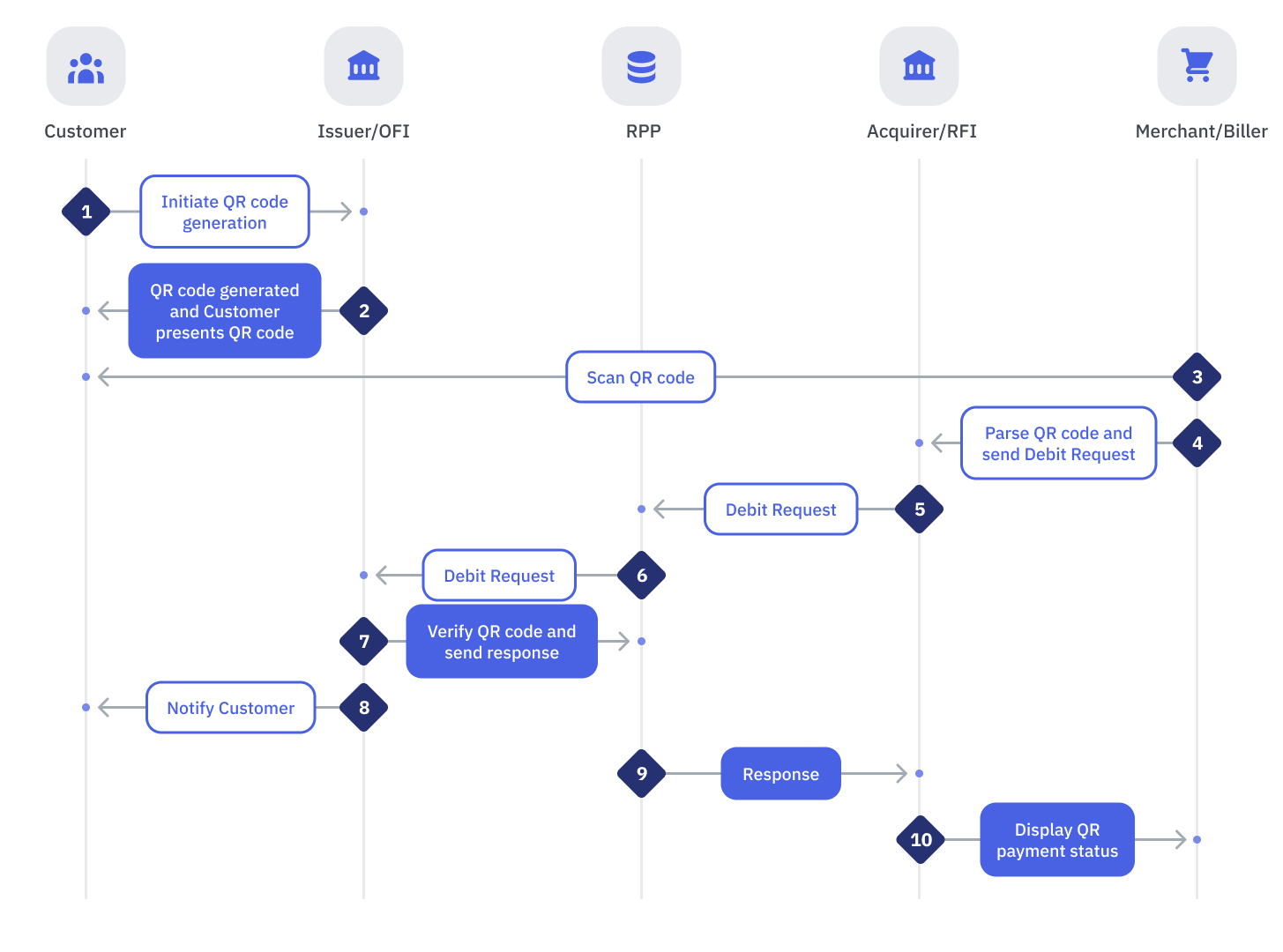

Successful End-to-End Consumer-Presented QR Flow

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Customer | Issuer | Customer logs into Online Banking or Mobile Banking app and initiates a QR code generation |

| 2 | Issuer | Customer | Issuer generates a QR code and Customer presents the generated QR to Merchant |

| 3 | Merchant | Acquirer | Merchant scans the QR code presented by the Customer |

| 4 | Merchant | Acquirer | Merchant initiates QR Debit request |

| 5 | Acquirer | RPP | Acquirer performs the following:

|

| 6 | RPP | Issuer | RPP performs the following:If any of the Message Validations fails:

|

| 7 | Issuer | RPP | RFI performs the following:If any of the Message Validations fails:

|

| 8 | Issuer | Customer | Issuer notifies Customer on QR payment status |

| 9 | RPP | Acquirer | RPP performs the following:If any of the Message Validations fails:

If the signature received from Issuer could not be verified:

|

| 10 | Acquirer | Merchant | Acquirer performs the following:If all validations are successful:

|

Pre-Authorization and QR Debit Request Flow

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Customer | Issuer | Customer logs into Online Banking or Mobile Banking app and initiates a QR code generation |

| 2 | Issuer | Customer | Issuer generates a QR code and Customer presents the generated QR to Merchant |

| 3 | Merchant | Acquirer | Merchant scans the QR code presented by the Customer |

| 4 | Merchant | Acquirer | Merchant initiates QR Debit request |

| 5 | Acquirer | RPP | Acquirer performs the following:

Notes:

|

| 6 | RPP | Issuer | RPP performs the following:If any of the Message Validations fails:

|

| 7 | Issuer | RPP | RFI performs the following:If any of the Message Validations fails:

|

| 8 | RPP | Acquirer | RPP performs the following:If any of the Message Validations fails:

If the signature received from Issuer could not be verified:

|

| 9 | Acquirer | Merchant | Acquirer performs the following:If all validations are successful:

|

| 10 | Merchant | Acquirer | Merchant scans the QR code presented by the Customer |

| 11 | Merchant | Acquirer | Merchant initiates QR Debit request |

| 12 | Acquirer | RPP | Acquirer performs the following:

|

| 13 | RPP | Issuer | RPP performs the following:If any of the Message Validations fails:

|

| 14 | Issuer | RPP | RFI performs the following:If any of the Message Validations fails:

|

| 15 | Issuer | Customer | Issuer notifies Customer on QR payment status |

| 16 | RPP | Acquirer | RPP performs the following:If any of the Message Validations fails:

If the signature received from Issuer could not be verified:

|

| 17 | Acquirer | Merchant | Acquirer performs the following:If all validations are successful:

|

Exception Flows

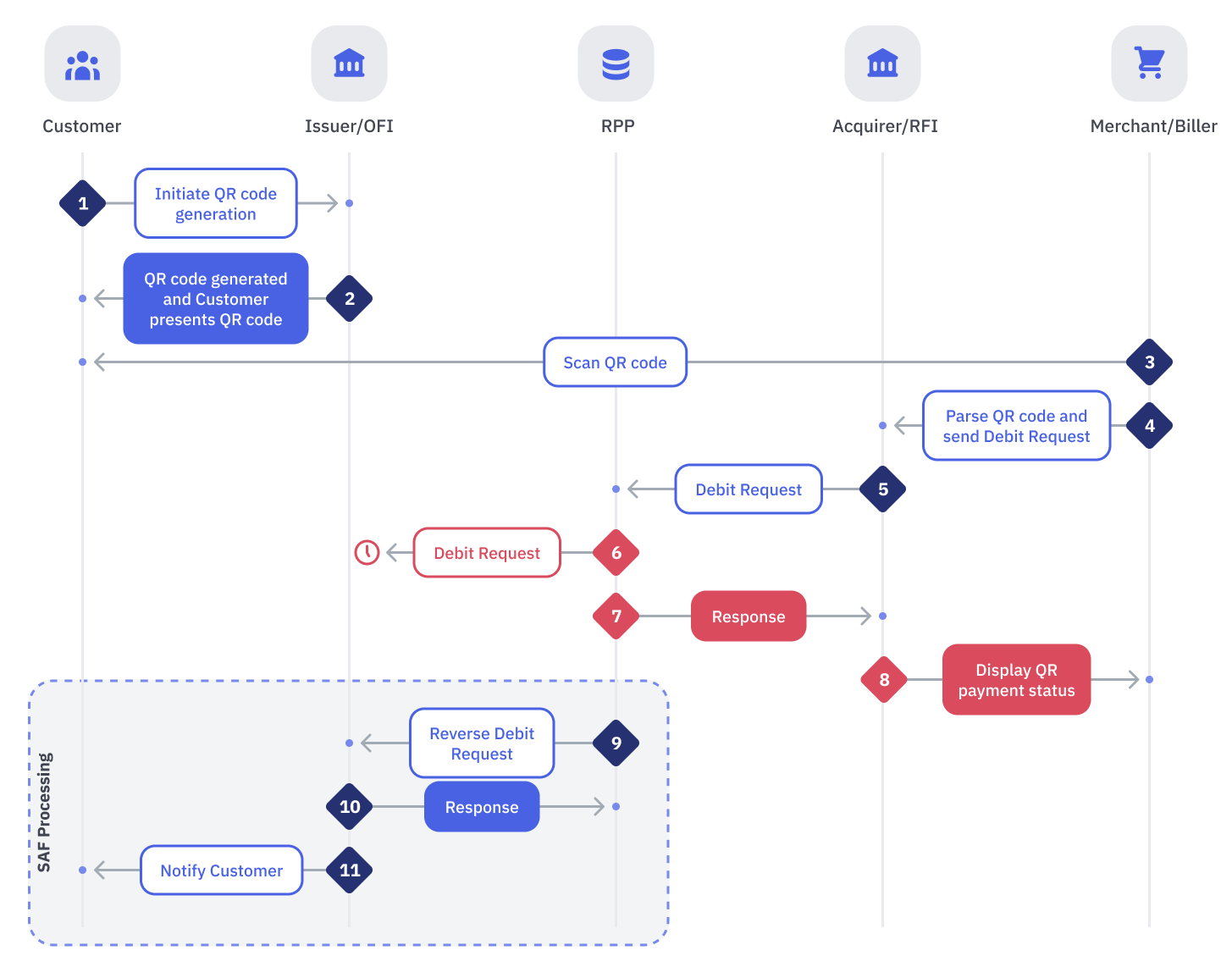

Issuer Failed to Receive Request from RPP

| Condition | Actions | Alternatives |

|---|---|---|

| RPP sent a request to Issuer, and Issuer did receive the request. However, Issuer response did not reach to RPP As no response is received from Issuer after x period of time, RPP eventually timeout | RPP shall:

| - |