Cross Border Inbound QR

Introduction

Supported Regions

| China | Indonesia | Singapore | Thailand | Cambodia | Korea |

|---|---|---|---|---|---|

The Inward Cross-Border QR enables customers with a foreign Bank Account to make payments via their chosen mobile banking appilication by scanning the QR code generated by local merchants in Malaysia.

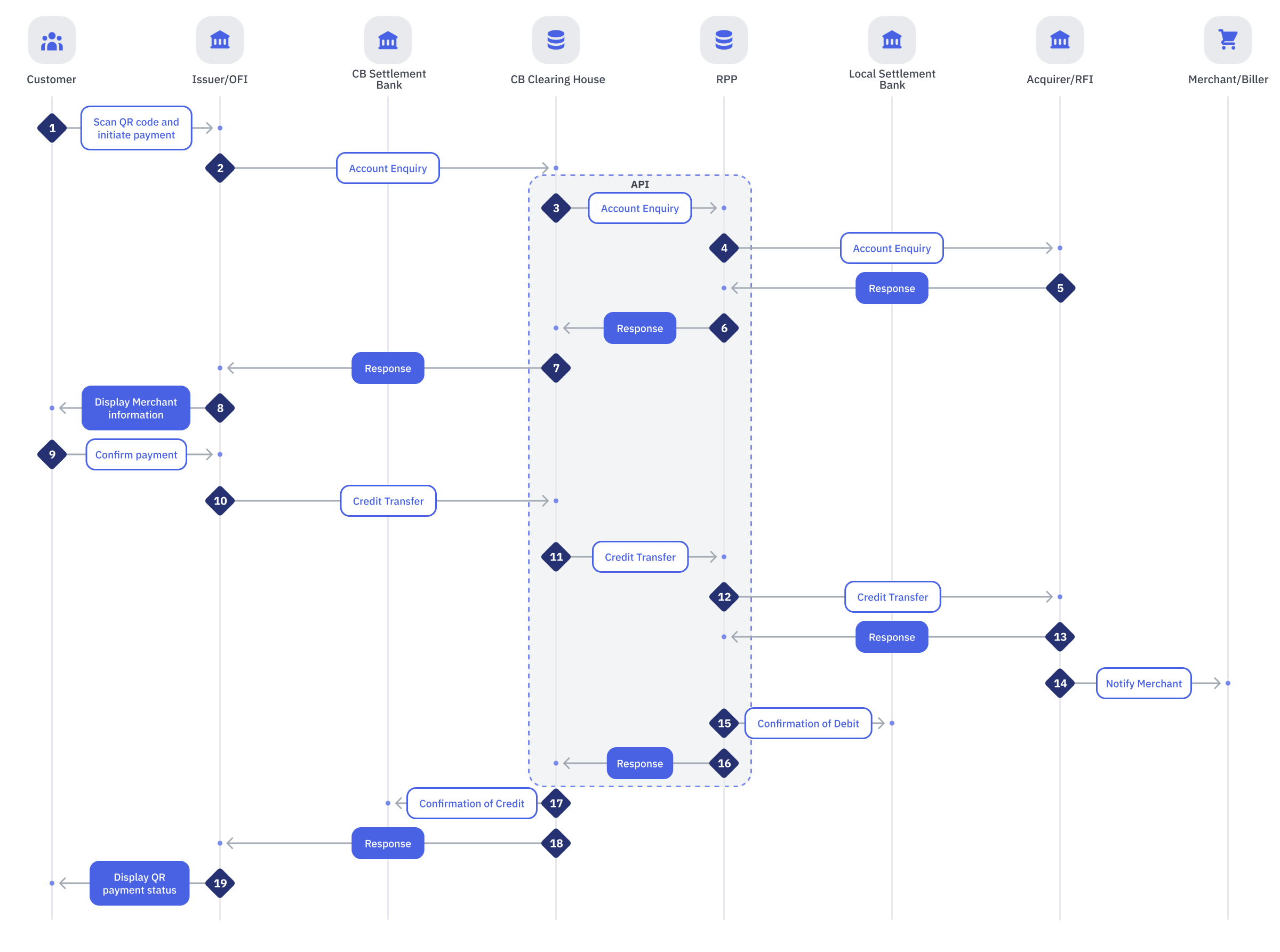

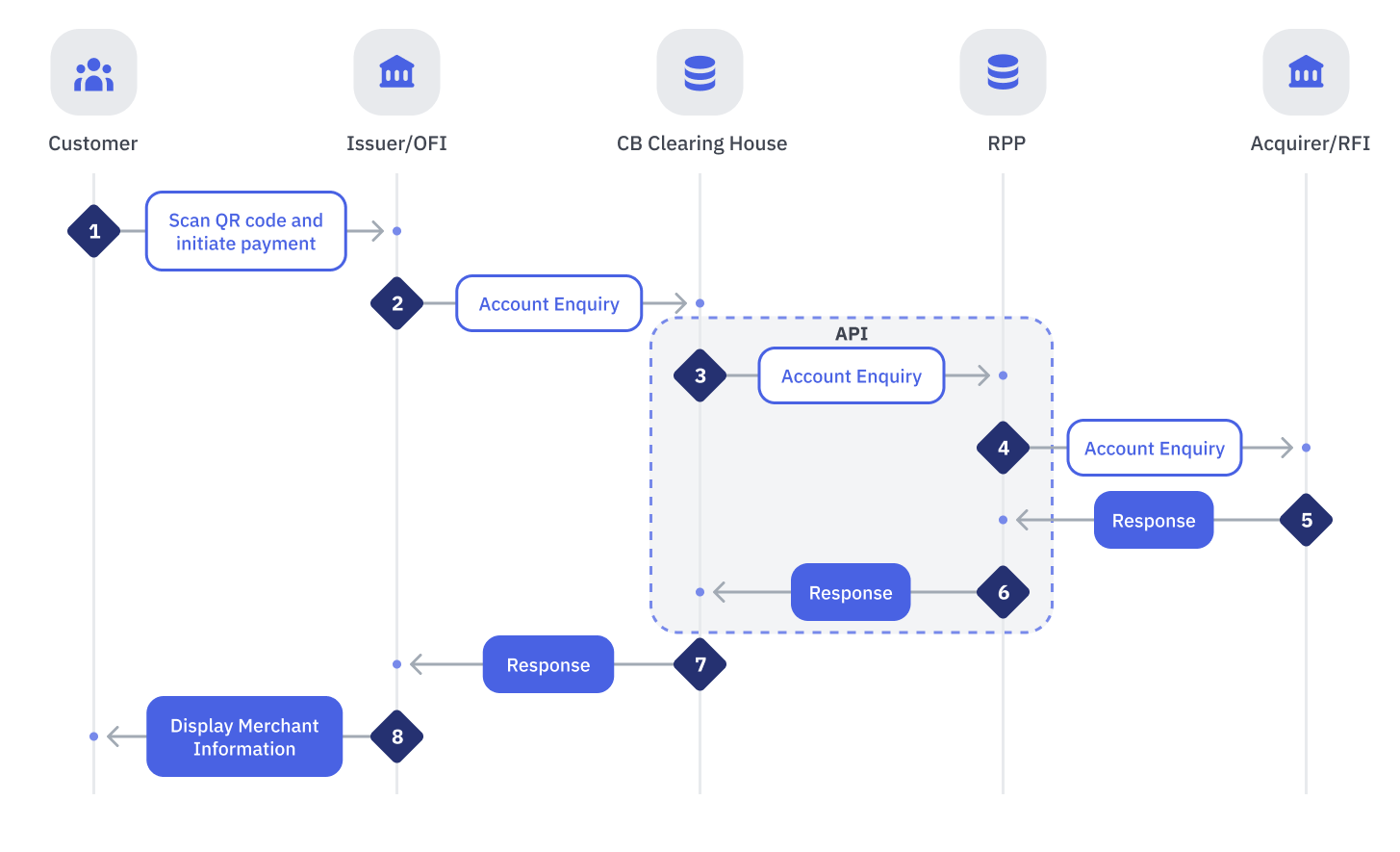

Account Enquiry Flow (Steps 1-8)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Customer | Issuer | Customer logs in to Mobile Banking App, scans a merchant’s QR and initiates a QR Payment request. |

| 2 | Issuer | CB Clearing House | Issuer performs the following:

|

| 3 | CB Clearing House | RPP | CB Clearing House performs the following:

If any Message Validation fails, CB Clearing House will send a REJECT response to Issuer. If any Business Validation fails, CB Clearing House will send a NEGATIVE response to Issuer. If all validations are successful, CB Clearing House will:

|

| 4 | RPP | Acquirer | RPP performs the following:

If any Message Validation fails, RPP will send a REJECT response to RPP. If any Business Validation fails, RPP will send a NEGATIVE response to CB Clearing House. If all validations are successful, RPP will:

|

| 5 | Acquirer | RPP | Acquirer performs the following:

If any Message Validation fails, Acquirer will send a REJECT response to RPP. If any Beneficiary Account Validation fails, Acquirer will send a NEGATIVE response to RPP. If all validations are successful, Acquirer will:

|

| 6 | RPP | CB Clearing House | RPP performs the following:

|

| 7 | CB Clearing House | Issuer | CB Clearing House performs the following:

|

| 8 | Issuer | Customer | Issuer performs the following:

|

Exception Handling

| Step(s) | Event | Action |

|---|---|---|

| 2 | Timeout - No response from CB Clearing House | When no response is received from Clearing House after x period of time: Issuer will:

|

| 2 | Rejection - Rejected by CB Clearing House | CB Clearing House:

Issuer:

|

| 3 | Timeout - No response from RPP | When no response is received from RPP after X period of time, the following actions should be taken: CB Clearing House:

Issuer:

|

| 3 | Rejection - Rejected by RPP | RPP:

CB Clearing House:

Issuer:

|

| 4 | Timeout - No response from Acquirer | When no response is received from Acquirer after x period of time, RPP:

CB Clearing House:

Issuer:

|

| 4 | Rejection - Rejected by Acquirer | Acquirer:

RPP

CB Clearing House:

Issuer :

|

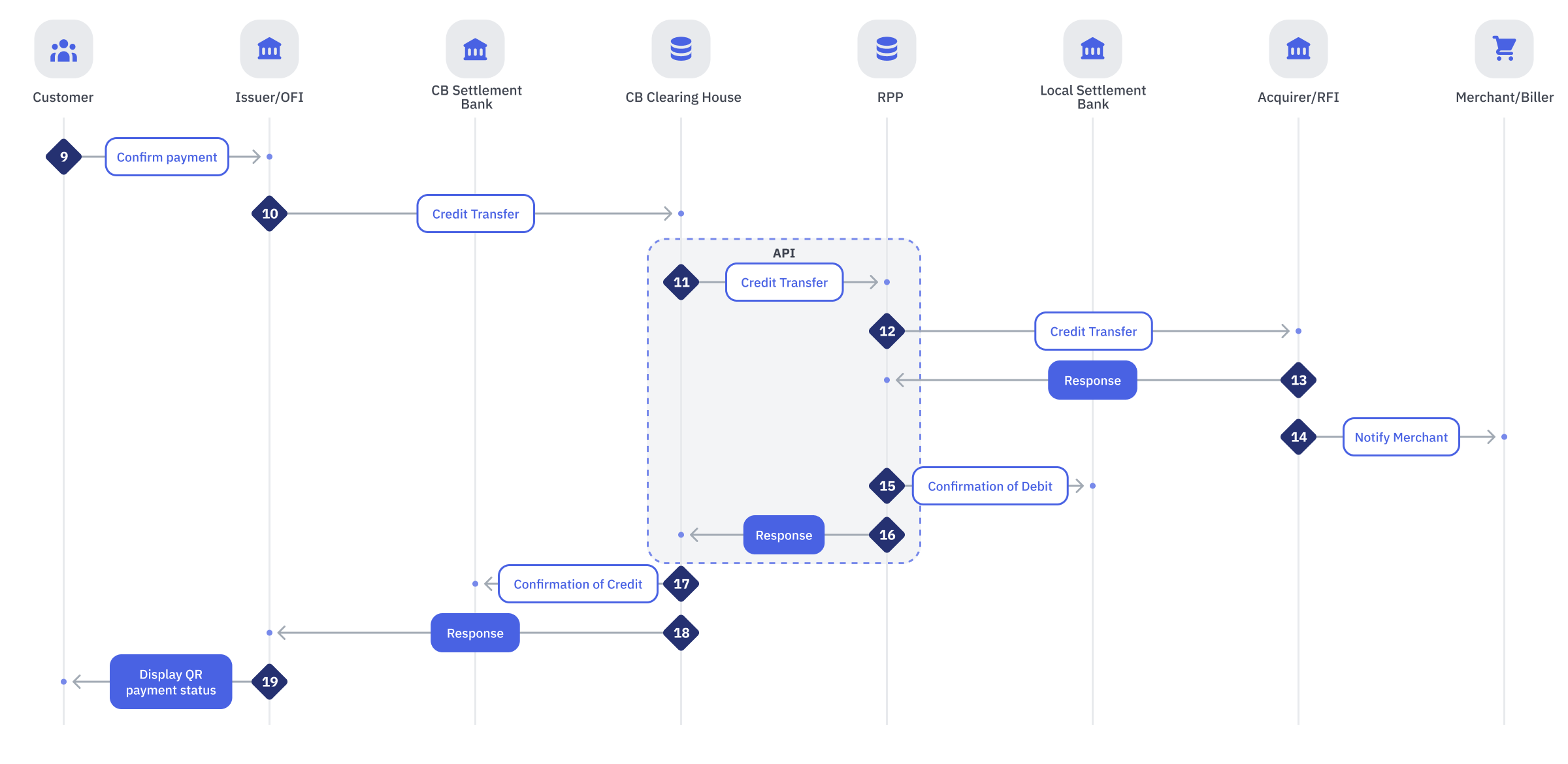

Credit Transfer Flow (Steps 9-19)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 9 | Customer | Issuer | Customer confirms the QR Payment. |

| 10 | Issuer | CB Clearing House | Issuer performs the following:

|

| 11 | CB Clearing House | RPP | CB Clearing House performs the following:

If any Message Validation fails, CB Clearing House will send a REJECT response to Issuer. If any Business Validation fails, CB Clearing House will send a NEGATIVE response to Issuer. If any Liquidity Position Check fails, CB Clearing House will send a NEGATIVE response to Issuer. If all validations are successful, CB Clearing House will:

|

| 12 | RPP | Acquirer | RPP performs the following:

If any Message Validation fails, RPP will send a REJECT response to CB Clearing House. If any Business Validation fails, RPP will send a NEGATIVE response to CB Clearing House. If all validations are successful, RPP will:

|

| 13 | Acquirer | RPP | Acquirer performs the following:

If any Message Validation fails, Acquirer will send a REJECT response to RPP. If Beneficiary Account Validation fails, Acquirer will send a NEGATIVE response to RPP. If all validations are successful, Acquirer will:

|

| 14 | Acquirer | Merchant | Acquirer notifies merchant on successful QR Payment status. |

| 15 | RPP | Local Settlement Bank | RPP sends notification of Debit to Local Settlement Bank. |

| 16 | RPP | CB Clearing House | RPP performs the following:

|

| 17 | CB Clearing House | CB Settlement Bank | CB Clearing House sends notification of Credit to CB Settlement Bank. |

| 18 | CB Clearing House | Issuer | CB Clearing House performs the following:

|

| 19 | Issuer | Customer | Issuer performs the following:

|

Exception Handling

| Step(s) | Event | Action |

|---|---|---|

| 10 | Timeout - No response from CB Clearing House | When no response is received from Clearing House after x period of time, Issuer will:

|

| 10 | Rejection - Rejected by CB Clearing House | CB Clearing House

Issuer:

If all validations are successful, Issuer will display an error message on the customer's screen |

| 11 | Timeout - No response from RPP | When no response is received from RPP after x period of time, the following actions should be taken: CB Clearing House will:

|

| 11 | Rejection - Rejected by RPP | RPP:

CB Clearing House:

Issuer:

|

| 12 | Timeout - No response from Acquirer | When no response is received from Acquirer after x period of time, RPP will:

CB Clearing House:

Issuer:

|

| 12 | Rejection - Rejected by Acquirer | Acquirer:

RPP:

CB Clearing House:

Issuer:

|

Validation Rules

| Message Validation | Business Validation |

|---|---|

| RPP:

Acquirer:

|